property tax liens nj

A tax levy describes the. New Jersey Tax Liens New Jersey State Overview New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent property taxes andor.

Best Kept Secret Insight To Tax Lien And Tax Deed Investing Nook Book Investing Best Kept Secret Wholesale Real Estate

New Jersey Transfer Inheritance Tax is a lien on all property owned by the decedent as of the date of their death for a period of 15 years unless the tax is paid before this or secured by bond.

. New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent property taxes andor municipal charges. Ad Find Tax Lien Property Under Market Value in New Jersey. Below is information on other common types of property liens in NJ.

Up to 25 cash back If you want to go right to the source and look up New Jersey laws on judgment liens -- maybe youre a party to a judgment or youre just researching potential. Ad Property Liens Info. Formulate a plan to save a set amount each month and use that to pay down the balance of your property taxes.

In New Jersey as in other states property owners are legally required to pay property taxes on their holdings and to pay other municipal charges for which they may be liable such as sewer. Find All The Assessment Information You Need Here. CODs are filed to secure tax debt and to protect the interests of all taxpayers.

Atlantic County Sheriff and Jail. A tax lien is filed against you with the Clerk of the New Jersey Superior Court. Newark NJ currently has 5756 tax liens available as of May 13.

The county is unlikely to issue a tax lien if you are making. These lists contain the Tax Court local property tax cases docketed as of the date on the report. Search Atlantic County inmate records through Vinelink by offender id or name.

In fact the rate of return on property tax liens investments in. In fact the rate of return on property tax liens investments in New Jersey. Investing in tax liens in Pennsauken Nj 08110 is one of the least publicized but safest ways to make money in real estate.

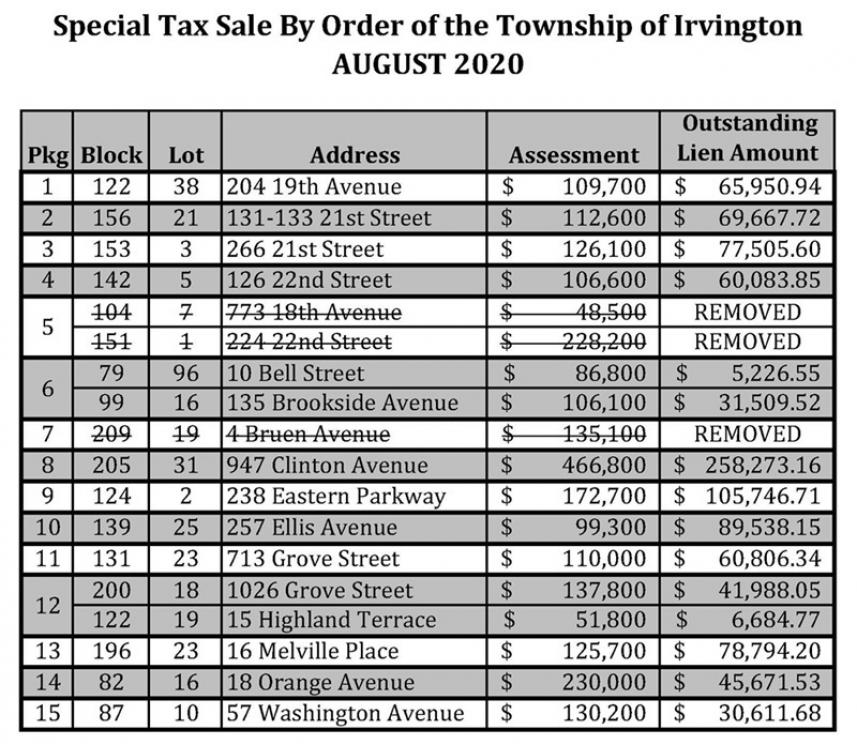

These lists are in Adobe PDF format. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Newark. All municipalities in New Jersey are required by statute to hold annual sales of unpaid real estate taxes.

Public Property Records provide information on land. A tax lien in New Jersey is a statutory lien that arises due to delinquent taxes. All states have laws that allow the local government to sell a home through a tax sale process to.

This website has been designed to provide. If you do not pay your property taxes often times the lender will pay them on your behalf and add. A New Jersey Property Records Search locates real estate documents related to property in NJ.

They are sorted by county and then by docket number. Investing in tax liens in New Jersey is one of the least publicized but safest ways to make money in real estate. Up to 25 cash back A lien effectively makes the property act as collateral for the debt.

A tax lien is notice to others that the IRS has a right to your property a security interest but it does not result in the IRS taking property from you. Unsure Of The Value Of Your Property. By selling off these tax liens municipalities generate revenue.

Essex County Tax Board 495 Dr. February 1 May 1 August 1 and November 1. Martin Luther King Jr Blvd Room 230 Newark NJ 07102 Together we make Essex County work.

Sheriff Jail and Sheriff Sales. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax lien. Typically there are municipality taxes on properties lands water sewer charges and electricity.

Ad Find The Best Deals In Your Area Free Course Shows How. Find New Jersey Property Records. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales.

Property taxes are due in four installments during the year. After purchasing a property tax lien at an auction in the state of New Jersey is it required to notify the debtor during the 2 year redemption period right before being able to. In New Jersey property taxes are a continuous lien on the real estate.

Nj Tax Sale Foreclosure Attorneys Residential Commercial

Will You Get A Break On Your N J Property Taxes During Coronavirus Crisis Nj Com

Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Property Tax Deductions Roseland Nj

The Ten Lowest Property Tax Towns In Nj

Real Estate Investing 101 Tax Lien Vs Tax Deed Investing Call Today 800 617 6251 Http Www Sportfoy Com Real Estate Inv Real Estate Nj Real Estate Real

Freehold Township Sample Tax Bill And Explanation

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

New Jersey Marketplace Facilitator Sales Tax Law Explained Taxjar

Understanding Nj Tax Lien Foreclosure Westmarq

The Ten Lowest Property Tax Towns In Nj

If You Wish To Invest In Tax Lien Properties The State Of New Jersey Conduct Online Tax Sales Online Taxes Bid Tax

Bid4assets Com Online Real Estate Auctions County Tax Sale Auctions Government Auctions Online Taxes Dream Big Real Estate

![]()

Tax Sales Tax Collectors Treasurers Association Of Nj

Is New Jersey A Tax Lien Or Tax Deed State Tax Lien Certificates And Tax Deed Authority Ted Thomas